Resident/Fellow Benefits

Joining a residency/fellowship connected to the UND School of Medicine & Health Sciences provides physicians with a number of benefits, including the following:

2025-2026 Resident Fellow Contract

The written contract governs the benefits available.

Effective Date

Disability insurance coverage begins on your first day of employment.

Ending Date

Disability insurance coverage ends on your last day of employment at 11:59pm.

Resident/Fellow Disability Insurance Cost to Resident/Fellow

No charge. Premium is paid by the School of Medicine and Health Sciences.

Definition of Disability

- You are disabled from your own occupation if, as a result of sickness, accidental bodily injury, or pregnancy, you are EITHER:

- Unable to perform with reasonable continuity the material duties of your own occupation; OR

- Unable to earn more than 80% of your Indexed Predisability Earnings while working in your own occupation.

Disability Elimination Period

Disability payment begins after 90 days of continuous disability. You will begin to accrue days towards this waiting period from the date you become disabled. (Usage of sick leave has no effect on the waiting period).

Disability Payment Coverage Amounts

- PGY-1's and 2's — $ 2,000 per month

- PGY-3's and up — $ 3,000 per month

Conversion Option

All residents/fellows leaving the program have the option to continue disability insurance coverage at their own expense. This must be done within 61 days of the resident leaving the UND program. You must be a citizen or a resident/fellow of the United States or Canada and have been on the UND group plan for at least 12 months to use this conversion option.

Exclusions and Limitations

- You are not covered for a disability caused or contributed to by a war.

- You are not covered for a disability caused or contributed to by an intentionally self-inflicted injury.

- You are not covered for a disability caused or contributed to by a pre-existing condition. (Please ask for additional information to clarify specific situations.)

The Employee Assistance Program (EAP) provider for the University of North Dakota is The Village Business Institute. The EAP is strictly confidential and makes counseling available free of charge to you and all members of your household.

Call 800.627.8220 to schedule an appointment at any location. Identify yourself as a member of the University of North Dakota.

Resident/Fellow Health Insurance Information

Residents/Fellows are offered the choice to participate in one of two health insurance plans: the NGF Your Blue 80/500 or the GF Comp Choice 80/100. Residents/Fellows may choose to change plans only during the Annual Enrollment Period.

Cost to Resident/Fellow

No charge. Premium is paid by the School of Medicine & Health Sciences.

Insurance Cards

Insurance cards are mailed to residents/fellows, but they can also go onto the new member portal and print a copy at bcbsndportals.com.

Coverage Effective and Ending Date

- Health insurance coverage will be effective immediately on the first day of employment.

- Coverage of the paid health insurance policy ends the last day of the month of the Resident's/Fellow's termination.

Eligible Dependents

- The Subscriber's (Resident's/Fellow's) spouse under a legally existing marriage as determined by the jurisdiction in which the marriage occurred.

- The Subscriber's (Resident's/Fellow's) children, or those of the Subscriber's living, covered spouse, who are under the age of 26 years. Newborn children, of an eligible member, are covered dependents from birth under the Family contract. Please ask for additional information concerning all child coverage definitions.

Changes in Coverage

The Subscriber (Resident/Fellow) is responsible for reporting any and all qualifying life events (e.g., birth, marriage) within 30 days of such change in BlueConnect. Refer to the BlueConnect Employee Guide (see page 6). Note: Subscribers have the option in BlueConnect to change health insurance plans when they have a qualifying life event.

Benefit Period Definition

Calendar year (January 1 through December 31)

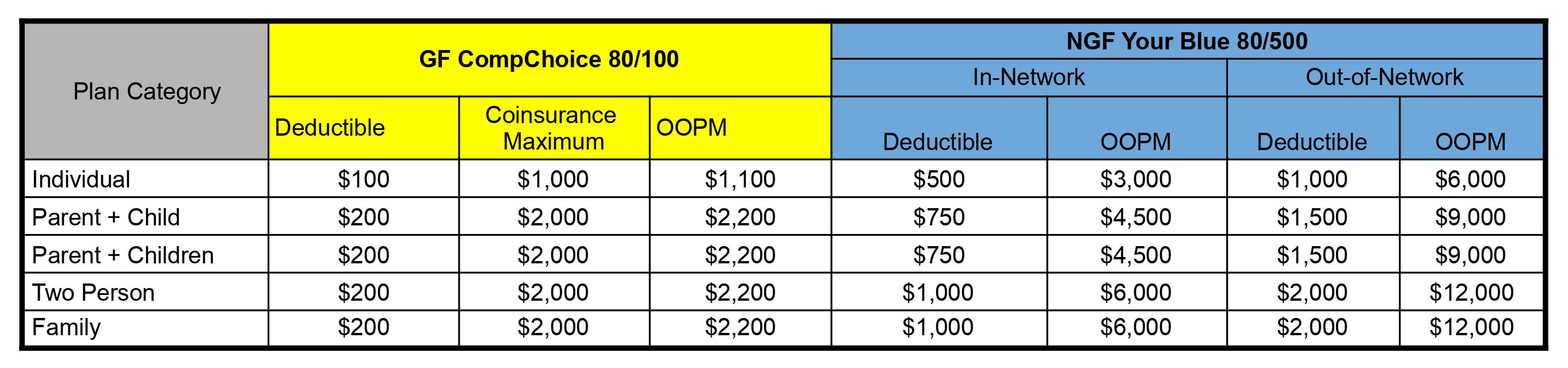

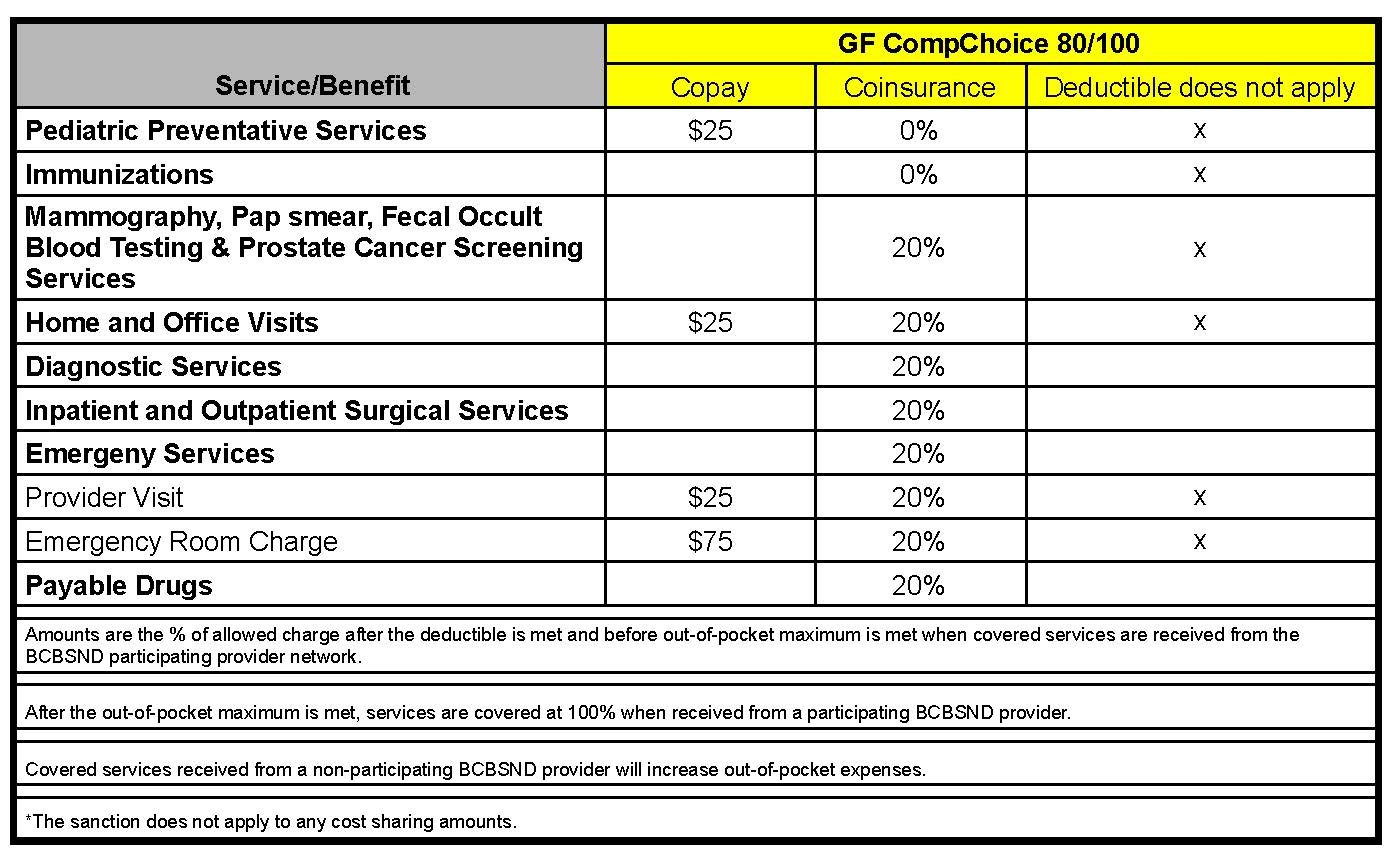

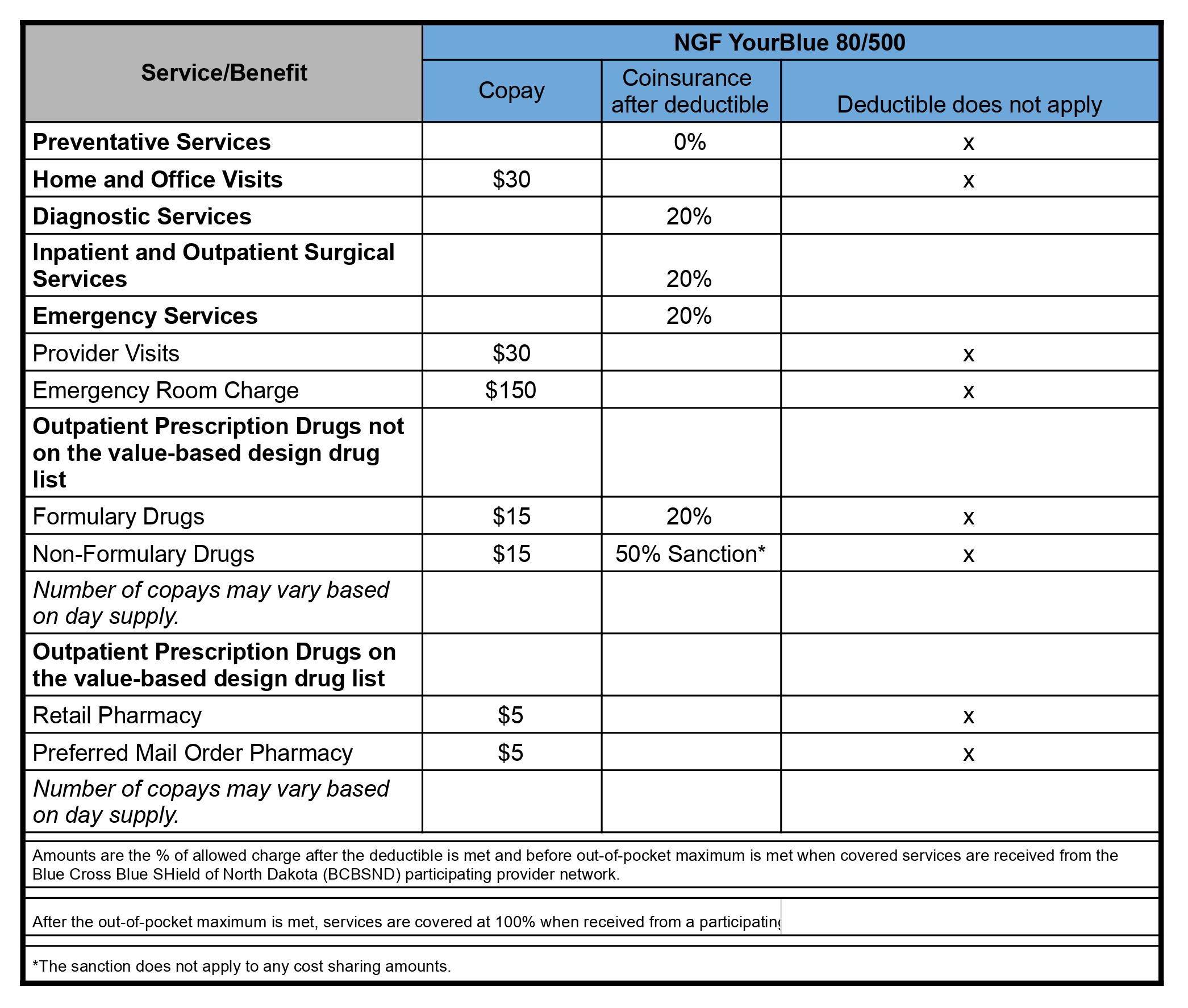

BCBS Summary of Plans

All Residents/Fellows should carefully review the plans before making an enrollment decision. Full plan materials are available to residents/fellows in the Blue Connect website. Please note that the NGF YourBlue 80/500 Plan has a comprehensive telehealth benefit and RX convenience, but its OOPM (Out of Pocket Maximum) is noticeably higher than the GF Comp Choice 80/100. While the GF Comp Choice 80/100 has a low OOPM, “Preventative care/screening” coverage is limited to pediatric preventive visits, mammography, pap smears, fecal occult blood testing, and prostate cancer screening. To explain further, annual physicals, along with blood tests, are NOT covered. Additionally, in the GF Comp Choice 80/100 plan, residents/fellows are required to pay for prescriptions out-of-pocket and get reimbursed up to one month later. Please refer to the below tables for a summary of the major features of both plans.

Deductible and Out of Pocket Maximums

Copay and Coinsurance After Deductible Amounts

This summary presents a brief explanation of the covered services and payment levels

of this product.

It should not be used to determine whether your health care expenses will be paid.

For additional information, please contact:

Misty Johnson

Blue Cross Blue Shield of North Dakota

3570 42nd St #B

Grand Forks, ND 58201

701.795.5340 or 800.342.4718

misty.johnson@bcbsnd.com

COBRA

COBRA is the federal law that entitles a member who becomes ineligible for coverage under the UND School of Medicine to continue health insurance coverage at their own expense. Please ask for further information.

The UND SMHS provides professional liability insurance coverage for physicians and medical residents/fellows performing medical procedures as part of their educational program. Physicians and medical residents/fellows who perform medical procedures or practice medicine outside of their educational program are not covered under the policy.

From time to time medical residents/fellows will perform procedures at facilities outside the medical school. Such activities may be compensated or uncompensated, but unless the medical resident/fellow involved in such activity has received prior approval from his or her Program Director, such activity will not be considered as within the parameters of the resident's/fellow's program, and the resident/fellow will not be within the coverage of the medical school liability policy.

Medical residents/fellows who anticipate performing medical procedures at facilities outside the medical school should request approval from their Program Director. Such approval will not be withheld unreasonably if the activity is, in the sole discretion of the Program Director, an essential activity relevant to the resident's/fellow's program.

Limits of Liability

- Health Care Professional Medical Liability $1,000,000 Limit Each Medical Incident, $5,000,000 annual aggregate

2026-2027 AY

- PGY-1 $69,510

- PGY-2 $71,685

- PGY-3 $74,408

- PGY-4 $77,446

- PGY-5 $81,052

- PGY-6 $85,156